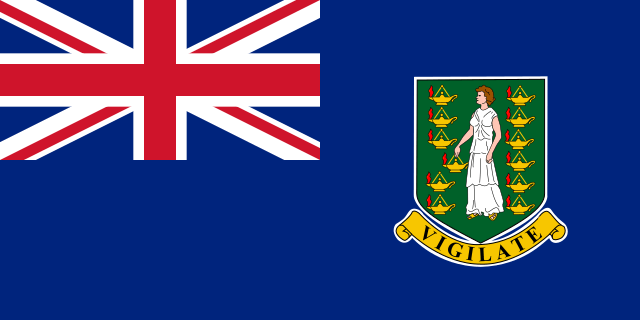

Alates 2019 Briti Neitsisaared (BVI) on vastu võtnud majandusliku sisu (ON) Euroopa Liidu surve all olevad määrused (ELI). Neid kohaldatakse mõne konkreetse tegevuse suhtes (a “Asjakohased tegevused”) mille jaoks enamik inimesi kasutaks BVI-d (St: Valdusettevõtted).

Iga äriühing või usaldusühing peab tõendama, et kas:

- it has an economic substance in the BVI (St: local employees and/or local managers)

- or it is tax residence somewhere else than the BVI.

It would make no sense (at least to most people) to hire local employees just for the sole purpose of creating an economic substance in the BVI. Although some big corporations might do this (a big thanks to the EU for boosting the local BVI economy!).

The only option left is to show tax residence from somewhere else than the BVI.

The International Tax Authority (ITA) of the BVI is responsible for examining such declaration under Rule 3:

(a) Certificates or letters issued by the competent tax authority of the other jurisdiction;

(b) tax assessments, demands, or evidence of payment issued by the competent tax authority of the other jurisdiction;

(c) tax returns submitted to the competent tax authority of the other jurisdiction;

or

(d) rulings issued by the competent tax authority of the other jurisdiction.

If a BVI company needs to register as a tax resident company in another jurisdiction than the BVI itself, then it makes no sense to incorporate in the BVI at all in the first place, a local company in that other jurisdiction is more straight-forward…

BVI = Best Varnished Islands.