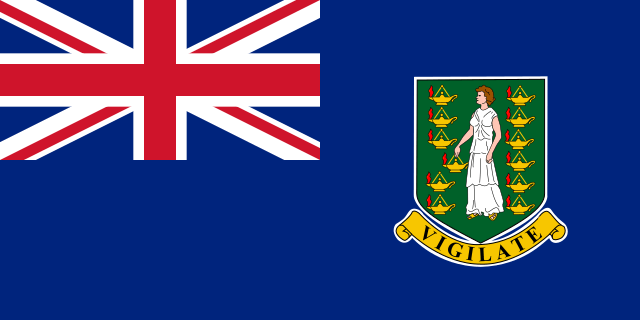

The British Virgin Islands (Isole Vergini Britanniche) adopts economic substance requirements applicable from 1 January 2019 (with a six-month transitional period for existing legal entities) if it conducts any of the following “relevant activities”:

- attività bancaria

- insurance business

- fund management business

- finance and leasing business

- attività di sede

- attività di spedizione

- holding business

- attività di proprietà intellettuale

- distribution and service centre business.

If the economic substance fail, the BVI non-resident company needs to show that it is resident (and taxed) in another jurisdiction. Companies registered in the BVI are widely used in Hong Kong.