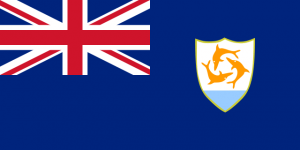

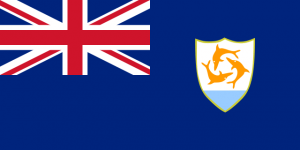

Anguilla adopted Economic Substance regulations

Anguilla has adopted Economic Substance regulations in a very detailed manner.

Anguilla has adopted Economic Substance regulations in a very detailed manner.

The Marshall Islands adopted Economic Substance Regulations applicable from the 1st January 2019. However it is interesting to note that: it applies strictly to relevant activities (distribution and service center business, financing and leasing business, headquarters business, holding company business, intellectual property business, shipping business, banking business, and insurance business) holding company business is defined…

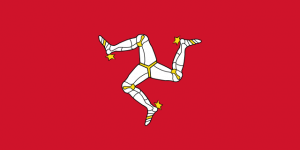

Like their flag with three legs: the Isle of Man prepares to triple kick with sanctions all the investors or companies that do not pass their economic substance’s tests.

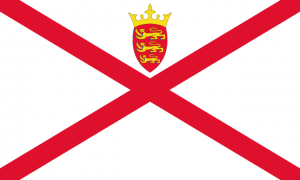

Upcoming laws are to be adopted in Jersey regarding Economic Substance for companies.

Taking effect on the 1st January 2019: Guernsey adopted Economic Substance laws.

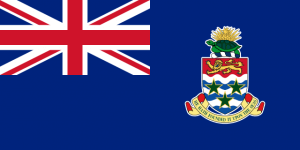

Already in force: the Cayman Islands adopted laws & regulations regarding economic substance requirements.

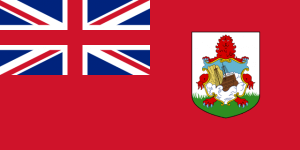

Bermuda is added to the list of jurisdictions adopting an Economic Substance Regime. Bermuda is used by numerous insurance companies (for example: AIA in Hong Kong) in order to lower the costs and avoid stamp duty on shares. Insurance companies already have on the ground staff in Bermuda so this should not be a problem…

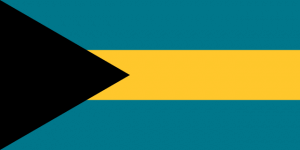

The Bahamas follow many other jurisdictions by adopting substantial economic presence requirements: activities must be conducted from the Bahamas.

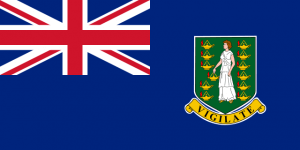

The British Virgin Islands (Brytyjskie Wyspy Dziewicze (BVI) adopts economic substance requirements applicable from 1 Styczeń 2019 (with a six-month transitional period for existing legal entities) if it conducts any of the following “relevant activities”: banking business insurance business fund management business finance and leasing business headquarters business shipping business holding business intellectual property business distribution and service…

Mauritius is phasing out their Global Business Companies (GBC) on the 30 czerwiec 2021. Only one single regime of GBC will survive, with 2 resident directors in Mauritius required, and a single 15% corporation tax rate.

Cenne Lite 2015 | Wszelkie prawa zastrzeżone. Motyw Precious Lite autorstwa Motywy muchowe