Anguilla adopted Economic Substance regulations

Anguilla has adopted Economic Substance regulations in a very detailed manner.

Anguilla has adopted Economic Substance regulations in a very detailed manner.

The Marshall Islands adopted Economic Substance Regulations applicable from the 1st January 2019. However it is interesting to note that: it applies strictly to relevant activities (distribution and service center business, financing and leasing business, headquarters business, holding company business, intellectual property business, shipping business, banking business, and insurance business) holding company business is defined…

Like their flag with three legs: the Isle of Man prepares to triple kick with sanctions all the investors or companies that do not pass their economic substance’s tests.

Upcoming laws are to be adopted in Jersey regarding Economic Substance for companies.

Entra em vigor a 1 de janeiro 2019: Guernsey adotou leis de Substância Econômica.

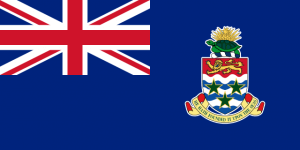

Already in force: the Cayman Islands adopted laws & regulations regarding economic substance requirements.

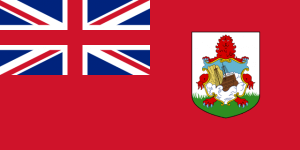

As Bermudas são adicionadas à lista de jurisdições que adotam um Regime de Substância Econômica. As Bermudas são usadas por várias companhias de seguros (por exemplo: AIA em Hong Kong) a fim de reduzir os custos e evitar o imposto de selo sobre as ações. Insurance companies already have on the ground staff in Bermuda so this should not be a problem…

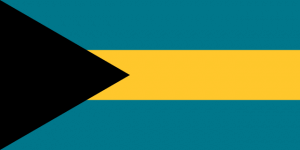

The Bahamas follow many other jurisdictions by adopting substantial economic presence requirements: activities must be conducted from the Bahamas.

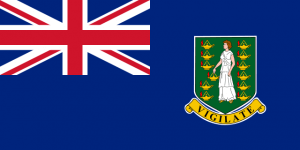

The British Virgin Islands (Ilhas Virgens Britânicas) adopts economic substance requirements applicable from 1 January 2019 (with a six-month transitional period for existing legal entities) if it conducts any of the following “relevant activities”: banking business insurance business fund management business finance and leasing business headquarters business shipping business holding business intellectual property business distribution and service…

Mauritius is phasing out their Global Business Companies (GBC) on the 30 June 2021. Only one single regime of GBC will survive, with 2 resident directors in Mauritius required, and a single 15% corporation tax rate.